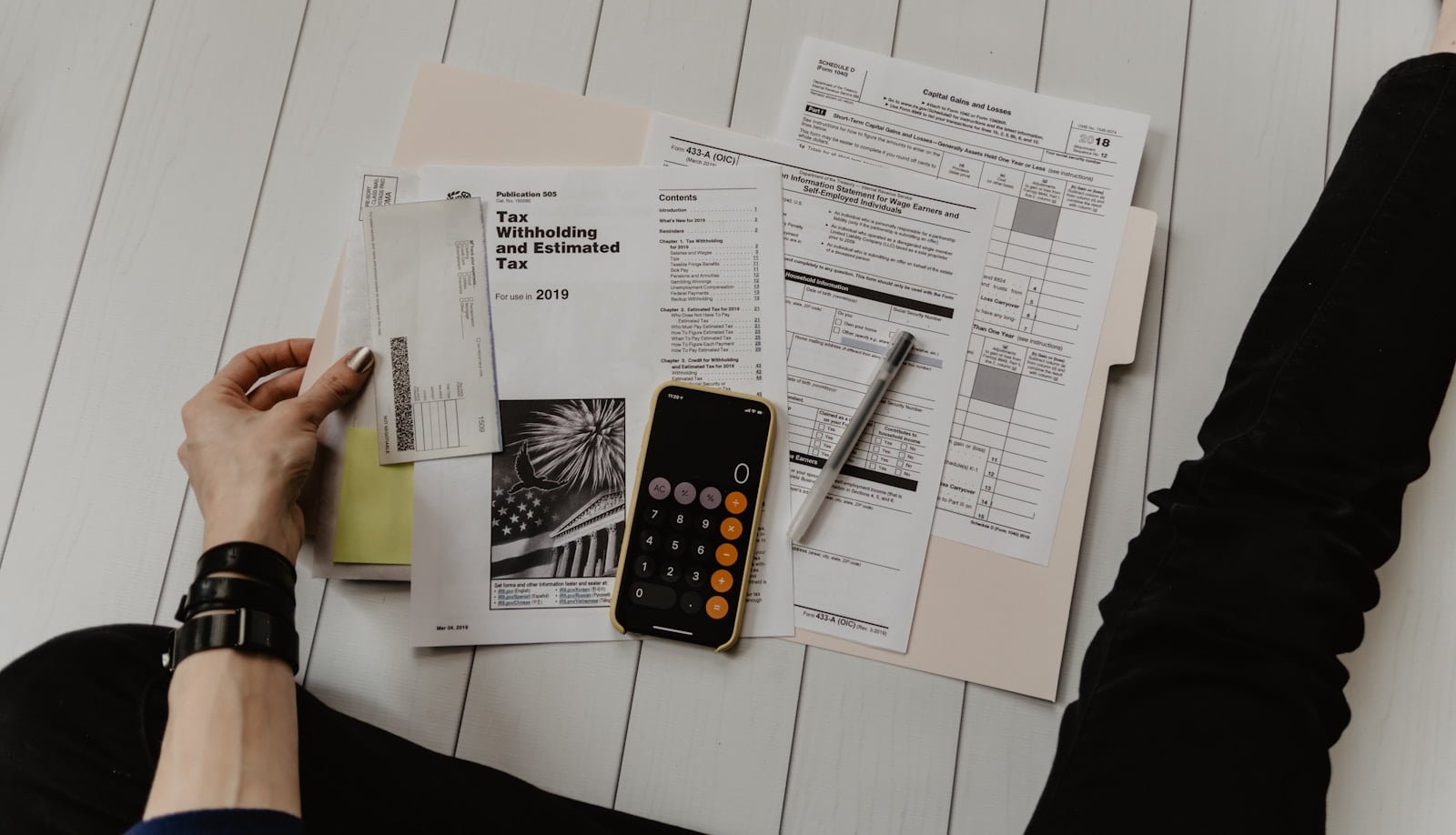

Strategic Financial Health: The Crucial Role of Year-Round Tax Planning for Small Businesses

Welcome to another episode of The Bottom Line, where we explore essential strategies for achieving financial success in business.

Let’s talk about year-round tax planning for small businesses—a crucial strategy for financial health. Instead of treating taxes as a once-a-year task, it’s an ongoing process that significantly affects a business’s stability and growth. Understanding year-round tax planning empowers entrepreneurs to make smart decisions, minimize taxes, and optimize finances throughout the year.

The Foundations of Year-Round Tax Planning

As we dive into year-round tax planning, let’s start by building a strong foundation. In this section, we’ll discover the basic principles that make effective tax planning for small businesses work. Understanding these key ideas will help entrepreneurs create a strong strategy that not only addresses immediate needs but also sets the stage for long-term financial health and resilience. Let’s explore the essential basics of successful year-round tax planning for small businesses.

#1 – Continuous Financial Monitoring:

Year-round tax planning starts with a proactive approach to financial management. Keep track of income, expenses, and investments regularly for accurate and up-to-date financial records.

#2 – Forecasting and Predictive Analysis:

Projecting financial outcomes helps anticipate tax obligations, enabling better resource allocation and cash flow management.

The Key Components of Year-Round Planning

Now that we have the basics in place, let’s explore the details of year-round tax planning. In this part, we’ll uncover the essential components that make up a complete strategy. This includes keeping up with rule changes and being proactive in financial decision-making. Each aspect is crucial in shaping the financial picture for small businesses.

#1 – Staying Ahead of Regulatory Changes:

Tax regulations change frequently; stay informed to ensure compliance and discover opportunities for optimization.

#2 – Proactive Financial Decision-Making

Year-round tax planning involves making strategic decisions throughout the year to identify tax-saving opportunities and allocate resources efficiently.

The Benefits of Year-Round Tax Planning

Now that we’ve covered the basics and understood the main elements of year-round tax planning, let’s talk about the practical benefits for small businesses. In this part, we’ll highlight the numerous advantages that come from having a well-thought-out and consistently applied year-round tax plan. These benefits range from being financially flexible to reducing risks, and they’re crucial for entrepreneurs aiming for lasting growth and resilience in the ever-changing business environment.

#1 – Maximizing Tax Efficiency:

Regular planning helps identify deductions, credits, and incentives throughout the year for optimal tax efficiency.

#2. – Avoiding Last-Minute Stress:

Proactive planning reduces the stress of rushed tax preparations and minimizes the risk of errors during tax filing season.

#3. – Strategic Decision-Making:

Insights gained from year-round planning enable informed decisions on investments, expenditures, and expansions.

Strategies for Effective Year-Round Tax Planning

As we continue our journey into year-round tax planning, it’s clear that developing a strong strategy is crucial for small businesses dealing with the complicated financial landscape. In this part, we’ll look into a variety of strategies aimed at improving tax results and enhancing financial well-being all year long. Whether it’s actively managing expenses or making the most of tax credits, these approaches empower entrepreneurs to steer their businesses towards lasting success by taking charge of their financial future.

#1. – Quarterly Financial Reviews:

Schedule regular quarterly reviews to assess financial performance, identify trends, and adjust tax strategies accordingly.

#2. – Timely Tax Payments:

Adhering to quarterly estimated tax payments prevents penalties and surprises during tax filing season.

#3. – Tracking Legislative Changes:

Stay updated on evolving tax laws and regulations, adapting strategies to leverage new opportunities or comply with changes.

#4. – Consulting Tax Professionals:

Engage with tax advisors or accountants throughout the year to gain insights, refine strategies, and ensure compliance.

Implementing Year-Round Tax Planning: Tips and Best Practices

Starting the year-round tax planning journey is a proactive move for financial empowerment in small businesses. In this part, we’ll dive into the hands-on aspects of putting a strong year-round tax plan into action. You’ll find a wealth of tips and best practices that aim to simplify the process, boost effectiveness, and make sure your tax strategy fits seamlessly with your business goals. By incorporating these practical insights into your financial toolkit, you’ll be well-prepared to handle the complexities of taxation and secure a stable financial future for your enterprise.

#1. – Utilizing Accounting Software:

Adopt accounting software for streamlined financial tracking and monitoring tax-related information.

#2. – Documenting Deductible Expenses:

Consistently record and categorize deductible expenses for accurate and comprehensive tax deductions.

#3. – Planning for Investments and Depreciation:

Strategically time investments and manage depreciation schedules to optimize tax benefits.

Year-round tax planning isn’t just a task; it’s a strategic approach fostering financial stability and growth. By embracing proactive financial management, small businesses can confidently navigate tax complexities, minimize tax burdens, capitalize on opportunities, and pave the way for sustainable success. Integrate year-round tax planning into your business framework to empower yourself and steer your business toward long-term financial health and resilience in a dynamic economic landscape.

Stay tuned and make every financial decision count!