The Importance of Profit Margins and How to Improve Yours

As a small business owner, understanding profit margins is crucial. Profit margins tell you how much money your business is making after covering its costs. Whether you run a bakery, a tech startup, or a landscaping company, knowing your margins can help you make smarter decisions, plan for growth, and weather tough times.

Here’s a simple guide to understanding profit margins and practical tips to improve them, with examples tailored for small businesses.

What Are Profit Margins?

Profit margins measure how much of your revenue is left as profit after you’ve paid for expenses. They are typically expressed as a percentage and come in three types:

1. Gross Profit Margin

This measures the profit after covering direct costs (like materials or labour).

- Formula: (Revenue – Cost of Goods Sold) ÷ Revenue × 100

- Example: A bakery sells $1,000 worth of cakes in a week. The ingredients and labour cost $400. The gross profit margin is: (1,000 – 400) ÷ 1,000 × 100 = 60%.

2. Operating Profit Margin

This measures profit after direct costs and operating expenses (like rent and utilities).

Example: If the bakery’s rent and utilities are $200, the operating profit margin is: (1,000 – 400 – 200) ÷ 1,000 × 100 = 40%.

3. Net Profit Margin

This is the final profit after all costs, including taxes and interest.

Example: If the bakery also pays $50 in taxes, the net profit margin is: (1,000 – 400 – 200 – 50) ÷ 1,000 × 100 = 35%.

Why Are Profit Margins Important?

1. Measure Financial Health

Profit margins give you a clear picture of how well your business is performing. If your margins are shrinking, it’s a sign to cut costs or increase revenue.

2. Plan for Growth

Healthy profit margins mean you can reinvest in your business. For example, you might expand your product line or open a second location.

3. Attract Investors and Lenders

Strong profit margins show that your business is stable and profitable, which can help you secure loans or attract investors.

What’s a Good Profit Margin for Canadian Small Businesses?

Profit margins vary by industry. For example:

- A restaurant might aim for a gross profit margin of 30-50%.

- A consulting firm could have a net profit margin of 15-25%.

- Retail businesses often see net profit margins of 5-10%.

Compare your margins to industry benchmarks to see how you’re doing. Resources like the BDC Industry Benchmark Tool can help.

How to Improve Your Profit Margins

1. Increase Prices Strategically

Small price increases can significantly boost margins. Ensure your prices reflect the value you provide.

Example: A hair salon in Vancouver raises haircut prices by 5%. Regular customers stay loyal because they value the quality service.

2. Reduce Costs

Look for ways to cut unnecessary expenses.

Example: A Toronto-based café switches to a local coffee supplier, reducing ingredient costs by 10%.

3. Focus on High-Margin Products or Services

Promote products or services that yield the highest profits.

Example: A boutique in Montreal focuses on selling premium handbags instead of low-margin accessories.

4. Streamline Operations

Use technology to improve efficiency and lower costs.

Example: A landscaping company in Calgary adopts scheduling software, reducing administrative work and saving on payroll costs.

5. Control Inventory

Overstocking ties up cash and increases storage costs.

Example: A clothing store in Winnipeg uses inventory management tools to avoid over-ordering seasonal items.

6. Minimize Waste

Reducing waste saves money, especially in industries like food or manufacturing.

Example: A bakery in Halifax monitors production closely to avoid making more pastries than it can sell.

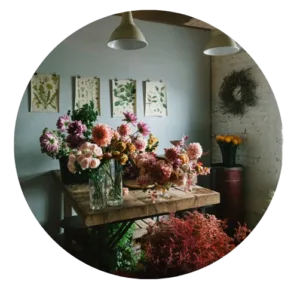

Example: Improving Margins in a Flower Shop

Anna owns a flower shop in Ottawa. Her gross profit margin was 50%, but her net profit margin was only 5%, partly due to high delivery costs. To improve her margins, Anna:

- Added a delivery fee, which boosted revenue.

- Negotiated better rates with suppliers, lowering costs by 8%.

- Introduced pre-order discounts, reducing the need for last-minute inventory purchases.

These changes increased her net profit margin to 12%, allowing her to invest in marketing and grow her customer base.

Final Thoughts!

Profit margins are a critical measure of your small business’s success. By understanding and improving them, you can boost your financial health, reinvest in growth, and achieve long-term stability. Whether it’s raising prices, cutting costs, or streamlining operations, small changes can make a big difference.

Use resources like the BDC and Canada Business Network for tips and tools tailored to Canadian entrepreneurs. Keep tracking your progress, and watch your margins—and your business—grow!

Stay tuned and make every financial decision count!

Need assisting with understanding profit margins? We can help!

References

- Business Development Bank of Canada (BDC) – Profitability Improvement Resources

- Investopedia – Understanding Profit Margins

- CPA Canada – Financial Literacy Resources

- BDC Industry Benchmark Tool – Provides industry-specific profit margin benchmarks to compare your business performance.

- Canada Revenue Agency – Business Resources – Provides tax information and financial management tools that affect business profitability.

- Lightspeed – Retail Inventory Management Tips – Advice on managing inventory efficiently to improve profitability.